Stage 3 Personal Tax Cuts Now Law!

The much-discussed stage 3 personal tax cuts have now passed through Parliament and become law, receiving royal assent on 5 March 2024. These new measures modify the personal tax rates and thresholds for the 2024-25 financial years onwards.

Cost of living pressure has driven the change to redistribute the savings to direct more into the hands of low and middle-income earners. Analysis by Treasury shows the redesigned personal tax cuts will spread the benefit of the tax cuts more evenly so regardless of your income you should receive a tax cut of between 1.5 to 2.5 per cent of taxable income (see chart below).

Source: Treasury Laws Amendment (Cost of Living Tax Cuts) Bill 2024 [and] Treasury Laws Amendment (Cost of Living – Medicare Levy Bill 2024), Treasury Parliament of Australia, (Bills Digest No. 42, 2023-24) 26 February 2024

It is important for individuals to understand that if you are a salary/wage earner these tax cuts will be built into the PAYG Withholding tax that your employer withholds on your behalf. This will mean more money in your regular pay cheque throughout the year and not as a lump sum when lodging your tax return.

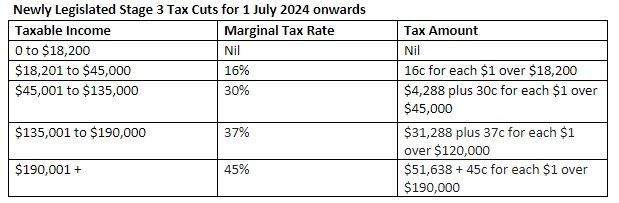

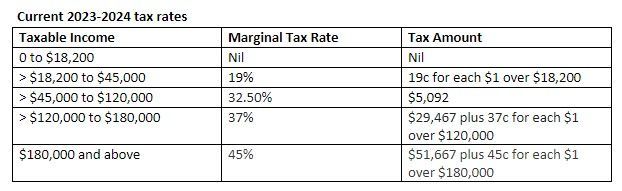

The tables below show tax rates and thresholds that you can expect to pay in tax for the current year 2023-24 and next financial year 2024-25.

For more information visit Treasury’s website or contact us at CoggerGurry today.

Sources:

Treasury website:

Treasury Bill Digest:

https://www.aph.gov.au/Parliamentary_Business/Bills_Legislation/bd/bd2324a/24bd42a

Tax Banter: