Investment Properties & Tax

Benefits, costs and key considerations

If you’re considering investing in property, you must understand the tax consequences. In Australia, like many other parts of the world, owning an investment property offers potential tax benefits and costs. From claiming deductions on interest payments and holding costs to understanding the nuances of Capital Gains Tax (CGT), property investors need a comprehensive grasp on these matters to make the most out of their investments.

Property investment tax benefits

Interest payments and holding costs

Owning a rental property comes with its share of expenses. However, many of these costs can be claimed as tax deductions if your property is up for rent or already rented out.

For property owners, ongoing expenses that can be used as a tax deduction are:

- The interest accumulating on a mortgage used to purchase a rental property.

- Property Management fees

- Council Rates

- Water Rates

- Land taxes

- Insurance Coverage

- Repairs & Maintenance

- Other upkeep-related costs such as general cleaning or landscaping & gardening.

Claiming depreciation on rental assets

When you purchase items for your rental property, such as new appliances, they lose value over time due to wear and tear. You can claim this loss in value as a tax deduction, often referred to as tax depreciation or capital allowance, and spread across the useful lifespan of that item.

Claiming for construction and renovations

You can claim these expenses as deductions if you’ve undertaken construction or renovation projects at your rental property. Typically, these capital works deductions are spread out throughout 25 to 40 years. The exact time frame will depend on the construction’s start date, purchase date, and intended use.

Offsetting losses with negative gearing

When your rental property’s expenses exceed earnings, resulting in a net loss, this is termed “negative gearing.” The upside to negative gearing is that you might be able to leverage this loss to counterbalance income from other sources, ultimately lowering your taxable income for the year.

Four types of tax on investment property

Income tax

The income from your rental property is subject to tax, just like your regular income. When lodging your income tax return, you must include the rental income alongside any other earnings, such as your salary or profits from other investments.

Capital Gains Tax (CGT)

If you are thinking of selling your rental property, be prepared for the potential of Capital Gains Tax. If you make money when selling your rental property, that profit is seen as a “capital gain.” This profit needs to be reported on your yearly tax return. The extra tax you owe because of this added profit is called Capital Gains Tax or CGT, and is taxed at your marginal tax rate.

Stamp Duty Tax

When you buy an investment property, you must pay a stamp duty tax. This tax is due when the property’s ownership changes hands from the seller to the buyer.

The Australian Taxation Office (ATO) doesn’t let you claim this as a tax deduction on your income tax return, but it can be added to the asset’s cost base for CGT purposes.

Stamp duty varies depending on:

- The state you’re in

- The property’s price

- If you’re a first-time buyer

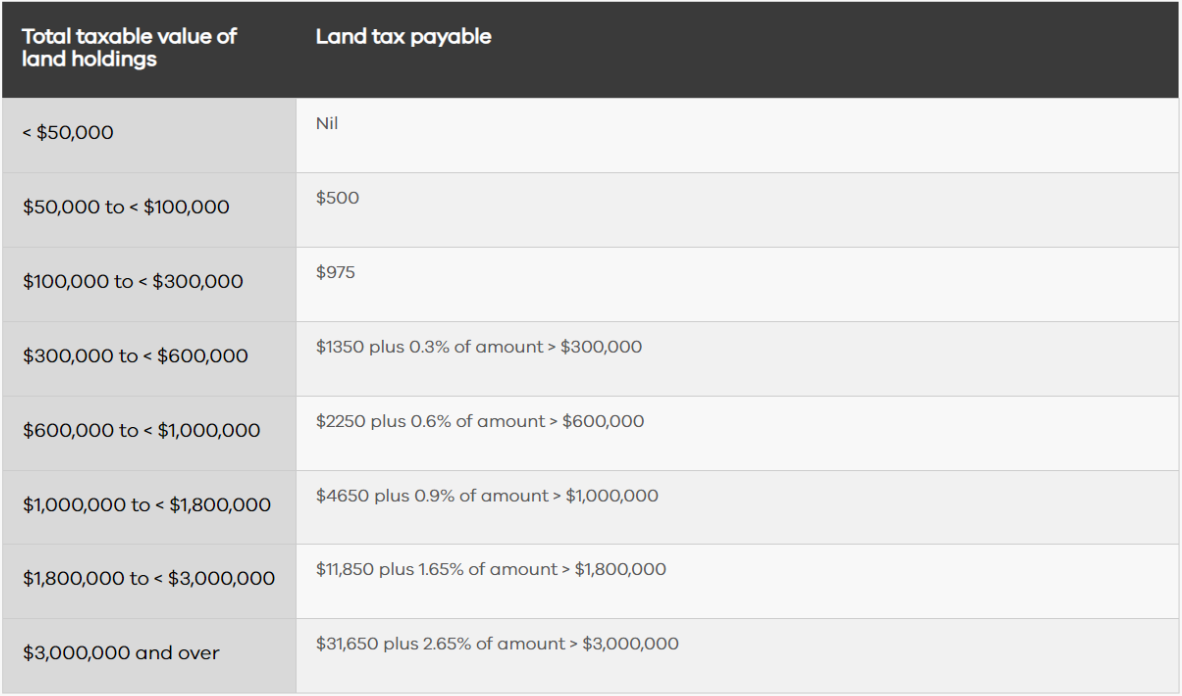

Land Tax

Land tax is different from stamp duty. While you pay stamp duty just once when you buy a property, land tax is an ongoing charge based on the land’s value unless the property is your primary home (often referred to as Principal Place of Residence or PPOR).

Every state and territory has a land tax rate based on the land’s “unimproved value.” This means that the value of buildings, walkways, landscaping, or fences on the land is not included when calculating land tax.

Land tax rates and thresholds for each state or territory are available on the Revenue Office websites for each state. Please note the Victorian Land Tax Rates are included in the table below.

If you want to learn more about the tax implications of holding property, contact us today.