Understanding Farm Household Allowance: Support for Farmers

Farm Household Allowance (FHA) is a critical support program designed to assist Australian farmers and their partners facing financial hardship. Whether due to unexpected weather conditions, illness, or market changes, FHA offers a safety net to help farming families regain stability.

What is Farm Household Allowance?

FHA provides eligible farmers with income support, delivered at the same rate as the JobSeeker Payment or Youth Allowance, for up to 4 years within a 10-year period. This allowance can be utilized as needed and does not have to be claimed consecutively. In addition to income support, FHA offers access to a $10,000 Activity Supplement to fund skill development or financial advice, and up to $1,500 for a professional financial assessment. Recipients also receive a Health Care Card, providing further cost-of-living relief.

How the Activity Supplement Can Help

The Activity Supplement is a significant part of the FHA program, designed to help farmers build resilience and improve their financial stability. The $10,000 supplement can be used for a wide range of activities, including accessing expert advice, training, and professional services that can enhance both on-farm and off-farm skills. For example, farmers can use the funds to hire agronomists, attend business courses, or seek financial planning advice. This support enables farming families to not only address immediate financial difficulties but also to build a stronger, more sustainable future.

Who is Eligible?

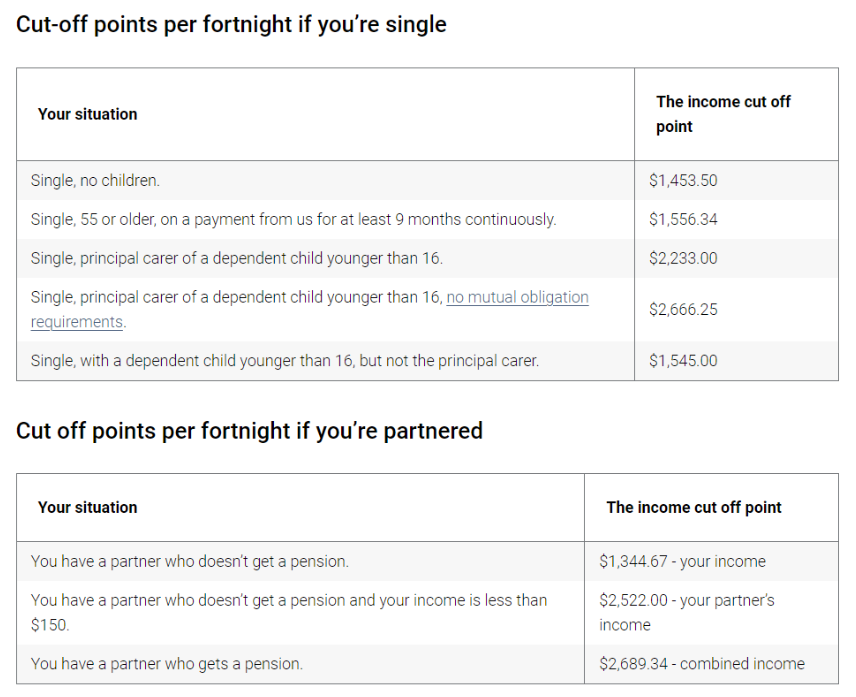

Eligibility for FHA depends on meeting specific income and asset tests, with net farm and personal assets needing to be below $5.5 million and income must be below the cut-off for the JobSeeker Payment income test amount (see Cut-off points tables below). It’s essential not to self-assess eligibility but to apply and allow Services Australia to determine your qualification.

Source: Services Australia website

How CoggerGurry Chartered Accountants Can Help

Applications can be submitted online through a myGov account linked to Centrelink. For those unable to apply online, paper forms are available. At CoggerGurry Chartered Accountants, we understand the complexities of managing farm finances, especially during challenging times. Our team can guide you through the FHA application process, ensuring all necessary documentation is complete and accurate. We can also assist in making the most of the Activity Supplement by connecting you with relevant experts and advisors. Whether you need help with financial planning, business strategy, or improving your farm operations, we can support you in utilizing these funds effectively.

For personalized assistance, contact CoggerGurry Chartered Accountants today and let us help secure your financial future.